How to start investing with little money

How to Start Investing with Little Money

The Importance of Just Getting Started

1) Building the habit: Starting to invest, even with small amounts, helps you develop a savings and investing habit. This financial discipline will serve you well as your income grows over time.

2) Learning the ropes: Beginning with smaller amounts allows you to learn about different investment options and strategies without risking significant capital. It’s a chance to gain experience and confidence.

3) Overcoming inertia: Often, the hardest part of any journey is taking the first step. By starting to invest now, you overcome the mental barrier that might be holding you back.

Developing Your Savings and Investing Muscle

1) Start Small: Begin by setting aside a small, fixed amount each month for investing. Even $20 or $50 a week can make a huge difference over time.

2) Increase Gradually: As you become more comfortable with investing, try to increase your contributions over time.

3) Stay Consistent: Regular, consistent investing is key. Set up automatic transfers to ensure you stick to your plan.

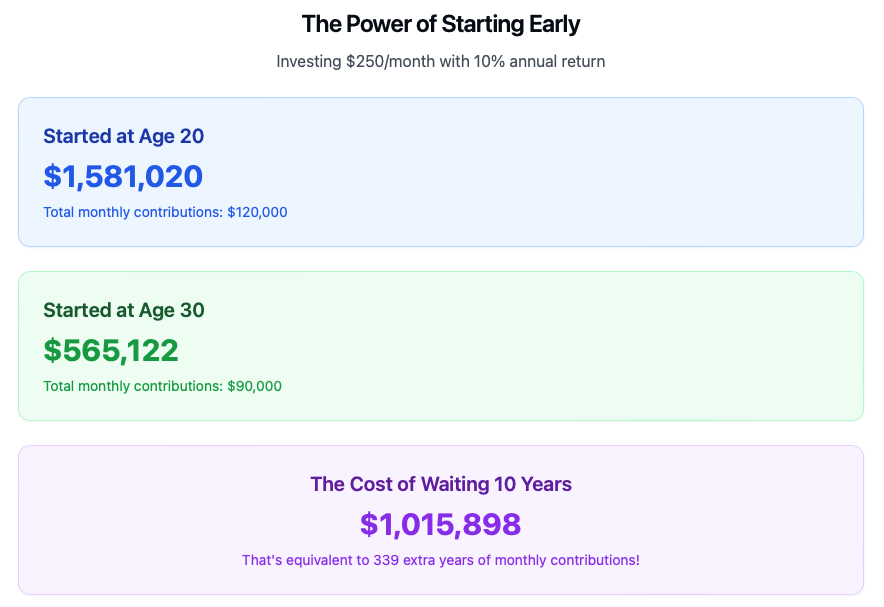

The Power of Compound Interest

Here’s an example:

Want to see how your retirements can grow?

Investment Plans to Consider

When starting your investment journey, it’s important to understand the different types of accounts available. Here are some popular options:

Retirement Accounts

1) 401(k): This is an employer-sponsored retirement plan. Many employers offer matching contributions, which is essentially free money. If your employer offers a match, try to contribute at least enough to get the full match.

2) Traditional IRA: Similar to a Roth IRA, but contributions are often tax-deductible now, and you pay taxes when you withdraw the money in retirement.

3) Roth IRA: This individual retirement account allows you to contribute after-tax dollars. Your money grows tax-free, and you can withdraw it tax-free in retirement. It’s a great option for young investors or those who expect to be in a higher tax bracket in retirement.

4) SEP IRA: This is a good option for self-employed individuals or small business owners.

Taxable Investment/Savings Accounts

1) Taxable Brokerage Account: An account with a brokerage like Fidelity, E*Trade, Charles Schwab which allows you to invest in stocks, bonds, index funds, etc.. While you won’t have the tax benefits if a retirement account, these accounts provide more freedom and flexibility in how and when you use your money

2) High Yield Savings Account: These accounts offer a higher interest rate than a traditional savings account with the same FDIC insurance coverage. A great place to park some cash for emergencies or other short term needs

3) Certificate of Deposits (CDs): A type of savings account offered by Credit Unions or Banks which typically offer a higher interest rate than a standard savings account but do not allow for withdrawals for a specified amount of time without incurring fees.

Options to Start Investing with Little Money

1) Index Funds: These low-cost funds track a market index and offer broad market exposure.

2) Mutual Funds: While some mutual funds require higher minimal initial investments, there are plenty of options with very low initial investments to get you started on your investing journey.

3) Exchange-Traded Funds (ETFs): These offer diversification and can be purchased for the price of a single share.

4) High Yield Savings Accounts: While not technically investing, these can be a good starting point for building your financial foundation.

Understanding the Risks

The Risks of Not Investing

Resources for Beginner Investors

Books:

1) The Simple Path to Wealth by JL Collins

2) Set for Life by Scott Trench

3) The Little Book of Common Sense Investing by John C. Bogle

Websites and Online Courses:

1) Investopedia.com – A comprehensive resource for financial education

2) Khan Academy’s personal finance courses – Free in-depth lessons on investing and personal finance

3) Yahoofinance.com: For investment research, analysis, and personal finance article

Podcasts:

1) The Ramsey Show – Focuses on getting out of debt and financial discipline

2) Afford Anything – Great for understanding the psychology of money

3) Stacking Benjamins – Makes finance fun and accessible

Conclusion

Building a Budget That Works

Building a Budget That Works

Building a budget that works: Your Path to financial success

Building a budget that works for you is one of the most important steps you can take to achieve financial stability and reach your goals. A truly effective budget balances financial responsibility with your lifestyle needs.

💰Step 1: Determine Your Net Income

Calculate your monthly income after taxes. Be sure to include income from side hustles, tip income, and any other income.

If you are self employed, don’t forget to account for taxes you’ll owe on this type of income. TaxAct has a self employment tax calculator which will help estimate your tax obligations.

📊 Step 2: Know Your Spending Habits

Before you begin building a budget that works, you need to know where your money is going. This means tracking your expenses, no matter how small.

Make sure to include large expenses that may not occur every month. Things like property taxes, insurance payments, vacations, Christmas, etc. Estimate the annual cost of and set aside a monthly amount for these type of expenses so you’re ready when the payments are due.

Use one of these methods:

📱 Budgeting apps like Monarch Money, EveryDollar, Quicken are relatively easy to use and can connect with your accounts to simplify the process

📑 Spreadsheets can be effective if you’re organized and diligent with your receipts

📓 Notebook for those old school folks who prefer pen and paper

How you track depends on your personal preference. Just start tracking so you have a basis to start from. You might be surprised at what you discover!

🤝 Step 3: Get on the Same Page with Your Partner

If you’re in a relationship, it’s crucial that you and your partner are aligned on financial goals and spending habits. Money can be a major source of conflict in relationships, but it doesn’t have to be.

Action item: Schedule a “money date” with your partner to discuss your financial goals, concerns, and habits. Make it a regular occurrence, perhaps monthly. Be sure to discuss both necessary expenses and discretionary spending.

🎯 Step 4: Tailor Your Budget to Your Lifestyle and Goals

There’s no one-size-fits-all approach to budgeting. Your budget should reflect your unique lifestyle and financial goals. Are you saving for a house? Planning for an early retirement? Paying off debt? Your budget should support these objectives while also allowing for some flexibility.

There’s no one-size-fits-all approach to budgeting. Your budget should reflect your unique lifestyle and financial goals. Are you saving for a house? Planning for an early retirement? Paying off debt? Your budget should support these objectives while also allowing for some flexibility.

Action item: Write down your short-term and long-term financial goals. Then, allocate your income accordingly in your budget, making sure to include categories for both necessities and discretionary spending.

💡 Pro Budget Tip

Focus on paying off credit card, car loans, personal loans, and any other consumer debt as quickly as possible. You’ll be amazed how quickly your net worth will increase when you eliminate your debt service payements

🎉 Step 5: Set Yourself Up for Success.

A good budget isn’t just about restriction—it’s about empowerment. Include some discretionary funds in your budget to avoid feeling overly constrained. Also, automate your savings and bill payments where possible to make sticking to your budget easier.

Action item: Set up automatic transfers to your savings account on payday. Start small if needed—even $20 a week adds up over time.

💡 Smart Budget Strategies

Automate Your Finances

* Set up automatic bill pay

* Create automatic transfers to savings

* Use direct deposit to separate accounts

🔍 Step 6: Regularly Review and Adjust

As your life circumstances change, so should your budget. Regular review ensures that your budget continues to align with your goals and needs.

Action item: Schedule quarterly budget reviews. Assess whether your current allocations are working. Are you meeting your saving goals? Is your budget sustainable? Adjust as necessary.

🏋️♂️ Step 7: Bounce Back When You Fall Off Track

Nobody’s perfect, and there will likely be times when you overspend or forget to track an expense. The key is not to let these slip-ups derail your entire budget. Instead, view them as learning opportunities.

Action item: When you go over budget, don’t beat yourself up. Instead, analyze what happened. Was it a one-time expense or a sign that your budget needs adjusting?

If you’re having trouble staying on track, try switching to cash for items like groceries, clothing, dining out, and miscellaneous shopping.

Use the Envelope System

- How It Works

1. Create labeled envelopes for each spending category

2. Fill with cash when you get paid

3. Once empty, stop spending

4. Limit borrowing between envelopes

Final Thoughts

Remember, budgeting is a skill that improves with practice. Be patient with yourself, celebrate your progress, and keep your eyes on your financial goals. With time and consistency, you’ll master the art of budgeting and pave the way for a secure financial future.

By creating a budget that addresses both your financial goals and your lifestyle needs, you’re setting yourself up for long-term success. A balanced approach ensures that you can maintain your quality of life while still preparing for the future. After all, the ultimate goal of financial planning isn’t just to save money—it’s to create a stable financial foundation that supports your life goals, both now and in the years to come.

The Joneses Are Poor

The Joneses are Poor

The Joneses are Poor...Why Trying to Keep up With "The Joneses" is a huge mistake

The Fallacy of Appearances

The Joneses are Poor: Drowning in Consumer Debt

Sacrificing the Future

The True Cost of Keeping up with the Joneses

Emotional Wellbeing

Financial Freedom

Embrace Authenticity and Personal Growth

Determine What is Important to You

Celebrate Your Successes