How to start investing with little money

How to Start Investing with Little Money

The Importance of Just Getting Started

1) Building the habit: Starting to invest, even with small amounts, helps you develop a savings and investing habit. This financial discipline will serve you well as your income grows over time.

2) Learning the ropes: Beginning with smaller amounts allows you to learn about different investment options and strategies without risking significant capital. It’s a chance to gain experience and confidence.

3) Overcoming inertia: Often, the hardest part of any journey is taking the first step. By starting to invest now, you overcome the mental barrier that might be holding you back.

Developing Your Savings and Investing Muscle💪

1) Start Small: Begin by setting aside a small, fixed amount each month for investing. Even $20 or $50 a week can make a huge difference over time.

2) Increase Gradually: As you become more comfortable with investing, try to increase your contributions over time.

3) Stay Consistent: Regular, consistent investing is key. Set up automatic transfers to ensure you stick to your plan.

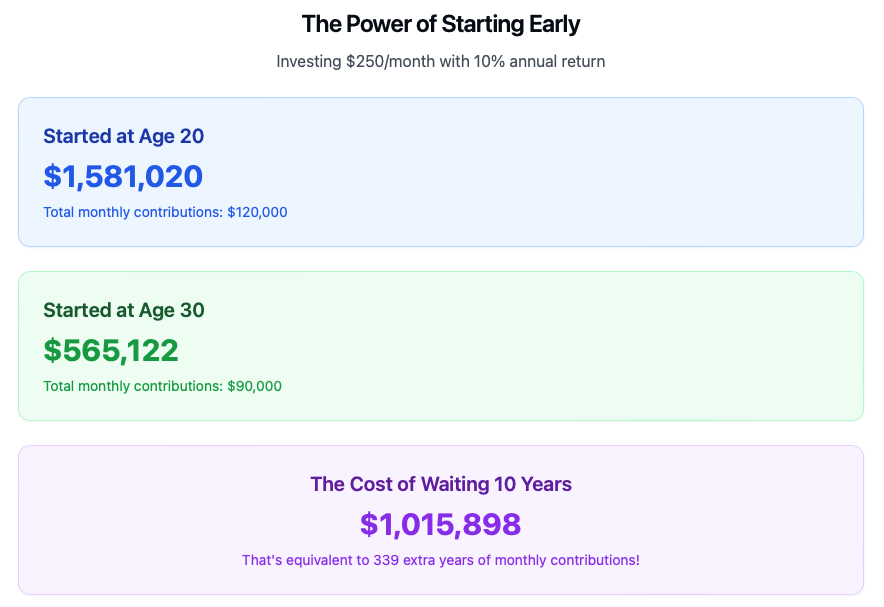

The Power of Compound Interest 📈

Here’s an example:

Want to see how your retirements can grow? 🌱

Investment Plans to Consider

When starting your investment journey, it’s important to understand the different types of accounts available. Here are some popular options:

Retirement Accounts

1) 401(k): This is an employer-sponsored retirement plan. Many employers offer matching contributions, which is essentially free money. If your employer offers a match, try to contribute at least enough to get the full match.

2) Traditional IRA: Similar to a Roth IRA, but contributions are often tax-deductible now, and you pay taxes when you withdraw the money in retirement.

3) Roth IRA: This individual retirement account allows you to contribute after-tax dollars. Your money grows tax-free, and you can withdraw it tax-free in retirement. It’s a great option for young investors or those who expect to be in a higher tax bracket in retirement.

4) SEP IRA: This is a good option for self-employed individuals or small business owners.

Taxable Investment/Savings Accounts💰

1) Taxable Brokerage Account: An account with a brokerage like Fidelity, E*Trade, Charles Schwab which allows you to invest in stocks, bonds, index funds, etc.. While you won’t have the tax benefits if a retirement account, these accounts provide more freedom and flexibility in how and when you use your money

2) High Yield Savings Account: These accounts offer a higher interest rate than a traditional savings account with the same FDIC insurance coverage. A great place to park some cash for emergencies or other short term needs

3) Certificate of Deposits (CDs): A type of savings account offered by Credit Unions or Banks which typically offer a higher interest rate than a standard savings account but do not allow for withdrawals for a specified amount of time without incurring fees.

Options to Start Investing with Little Money

1) Index Funds: These low-cost funds track a market index and offer broad market exposure.

2) Mutual Funds: While some mutual funds require higher minimal initial investments, there are plenty of options with very low initial investments to get you started on your investing journey.

3) Exchange-Traded Funds (ETFs): These offer diversification and can be purchased for the price of a single share.

4) High Yield Savings Accounts: While not technically investing, these can be a good starting point for building your financial foundation.

Understanding the Risks⚠️

The Risks of Not Investing

Resources for Beginner Investors

Books:

1) The Simple Path to Wealth by JL Collins

2) Set for Life by Scott Trench

3) The Little Book of Common Sense Investing by John C. Bogle

Websites and Online Courses:

1) Investopedia.com – A comprehensive resource for financial education

2) Khan Academy’s personal finance courses – Free in-depth lessons on investing and personal finance

3) Yahoofinance.com: For investment research, analysis, and personal finance article

Podcasts:

1) The Ramsey Show – Focuses on getting out of debt and financial discipline

2) Afford Anything – Great for understanding the psychology of money

3) Stacking Benjamins – Makes finance fun and accessible

Conclusion

Poor is a State of Mind

Poor is a State of Mind

Poor Is a State of Mind: 5 Steps to Build a Growth-Oriented Money Mindset

I know the phrase “poor is a state of mind” can raise eyebrows. To be clear: this isn’t about dismissing real financial struggles, ignoring economic barriers, or blaming individuals for their current circumstances. `Instead, it’s about recognizing one powerful truth—your financial mindset can either trap you in limitation or propel you toward resilience, creativity, and growth.

How a Positive Money Mindset Can Transform Your Finances ✨

Life will always throw challenges your way—but your money mindset and how you respond determines the outcome. A strong, growth-focused mindset doesn’t erase difficulties, but it does give you the resilience to push through them.

With the right perspective, you can:

- 💪 See your worth beyond your bank balance

- 🔄 Turn setbacks into comebacks

- 🎯 Get creative about solving money problems

- 🔥 Use failure as fuel for growth

- 🚀 Pair hope with consistent action to unlock your potential

My Journey: Humble but Hopeful Beginnings 🌱

Like many, I started with financial struggles. I had big dreams to become a millionaire by age 30—but without a plan, that dream quickly faded. What I held onto, though, was a mindset of determination.

Even when I was broke, dealing with unexpected car repairs, or scraping by paycheck to paycheck, I refused to let those moments define me. I knew being “poor” wasn’t my identity—it was a temporary state.

Over time, I realized:

- Success isn’t about wealth alone.

- Every struggle can become a stepping stone.

- Believing in your ability to grow is the first step toward real change.

Breaking the Poverty Mindset: Why Hope Matters 💭

Too many people today lose hope when life gets hard. They confuse “being broke” with “being poor.”

Here’s the difference:

- Being broke 💵 is temporary—it’s a financial situation.

- Being poor 🚫 is a mindset—a belief that things will never improve.

When you adopt a poor mindset, motivation disappears. But if you choose to see obstacles as opportunities, you give yourself the power to change your personal finances.

5 Practical Steps to Build a Growth-Oriented Financial Mindset 🔥

A mindset shift is powerful, but it needs to be backed by action. Here are five practical steps to get started:

1. Improve Your Money Knowledge 📚

Education is the ultimate wealth builder. Start small—read books, listen to podcasts, or take online courses. Over time, your confidence and financial literacy will grow.

Books that changed my money mindset:

- The Millionaire Next Door by Thomas Stanley

- Set for Life by Scott Trench

- Total Money Makeover by Dave Ramsey

Podcasts worth your time:

2. Track Your Spending & Create a Budget That Works 📝

You may be surprised how much slips away on restaurants, subscriptions, or small impulse buys. Track every dollar for a month—you’ll see patterns clearly and improve your budgeting.

From there, create a budget that lets you spend on what you love and cut back on what doesn’t matter as much.

📊 Take control of your finances today: Learn how to create a budget that really works!

3. Set Financial Goals and Plan Your Ideal Lifestyle 🌟

Think about the lifestyle you want and write it down. Break it into smaller, achievable milestones, and use them to build momentum toward your vision.

4. Rethink Your Relationship With Money 💡

If you see money as the root of all evil, you may unconsciously hold yourself back. Instead, view money as a tool that creates freedom and expands your options.

5. Practice Generosity 🎁

Giving reinforces an abundance mindset. Even small acts of kindness or intentional giving show that money is a resource to be shared, not hoarded.

The Bottom Line ✅

Believing “poor is a state of mind” doesn’t mean mindset is the only factor in financial success—but it is a foundational one. When you pair a positive outlook with education, discipline, and consistent action, you give yourself the best chance to break free from limitations, overcome adversity, and build the future you want.

You already have the power to shift your mindset. Now it’s time to use it. 💡