How to start investing with little money

How to Start Investing with Little Money

The Importance of Just Getting Started

1) Building the habit: Starting to invest, even with small amounts, helps you develop a savings and investing habit. This financial discipline will serve you well as your income grows over time.

2) Learning the ropes: Beginning with smaller amounts allows you to learn about different investment options and strategies without risking significant capital. It’s a chance to gain experience and confidence.

3) Overcoming inertia: Often, the hardest part of any journey is taking the first step. By starting to invest now, you overcome the mental barrier that might be holding you back.

Developing Your Savings and Investing Muscle💪

1) Start Small: Begin by setting aside a small, fixed amount each month for investing. Even $20 or $50 a week can make a huge difference over time.

2) Increase Gradually: As you become more comfortable with investing, try to increase your contributions over time.

3) Stay Consistent: Regular, consistent investing is key. Set up automatic transfers to ensure you stick to your plan.

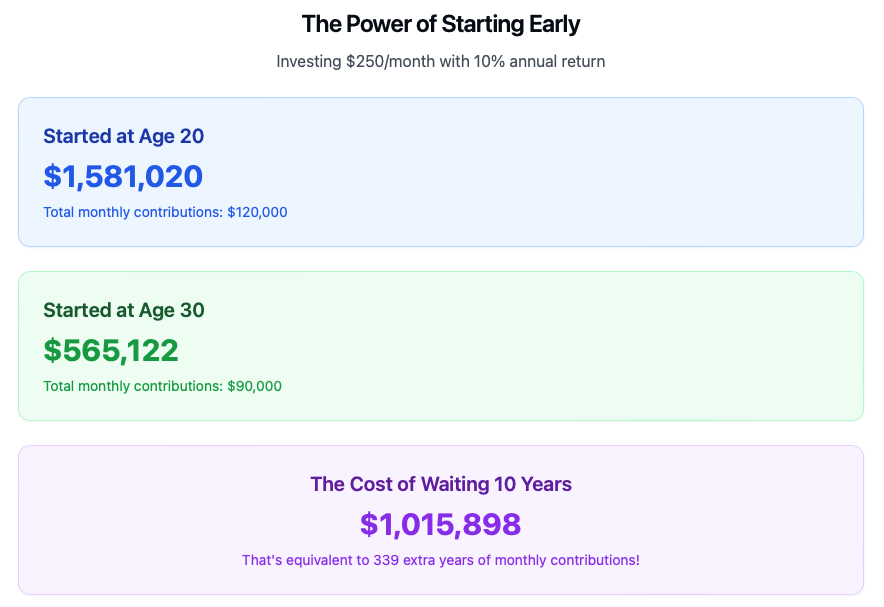

The Power of Compound Interest 📈

Here’s an example:

Want to see how your retirements can grow? 🌱

Investment Plans to Consider

When starting your investment journey, it’s important to understand the different types of accounts available. Here are some popular options:

Retirement Accounts

1) 401(k): This is an employer-sponsored retirement plan. Many employers offer matching contributions, which is essentially free money. If your employer offers a match, try to contribute at least enough to get the full match.

2) Traditional IRA: Similar to a Roth IRA, but contributions are often tax-deductible now, and you pay taxes when you withdraw the money in retirement.

3) Roth IRA: This individual retirement account allows you to contribute after-tax dollars. Your money grows tax-free, and you can withdraw it tax-free in retirement. It’s a great option for young investors or those who expect to be in a higher tax bracket in retirement.

4) SEP IRA: This is a good option for self-employed individuals or small business owners.

Taxable Investment/Savings Accounts💰

1) Taxable Brokerage Account: An account with a brokerage like Fidelity, E*Trade, Charles Schwab which allows you to invest in stocks, bonds, index funds, etc.. While you won’t have the tax benefits if a retirement account, these accounts provide more freedom and flexibility in how and when you use your money

2) High Yield Savings Account: These accounts offer a higher interest rate than a traditional savings account with the same FDIC insurance coverage. A great place to park some cash for emergencies or other short term needs

3) Certificate of Deposits (CDs): A type of savings account offered by Credit Unions or Banks which typically offer a higher interest rate than a standard savings account but do not allow for withdrawals for a specified amount of time without incurring fees.

Options to Start Investing with Little Money

1) Index Funds: These low-cost funds track a market index and offer broad market exposure.

2) Mutual Funds: While some mutual funds require higher minimal initial investments, there are plenty of options with very low initial investments to get you started on your investing journey.

3) Exchange-Traded Funds (ETFs): These offer diversification and can be purchased for the price of a single share.

4) High Yield Savings Accounts: While not technically investing, these can be a good starting point for building your financial foundation.

Understanding the Risks⚠️

The Risks of Not Investing

Resources for Beginner Investors

Books:

1) The Simple Path to Wealth by JL Collins

2) Set for Life by Scott Trench

3) The Little Book of Common Sense Investing by John C. Bogle

Websites and Online Courses:

1) Investopedia.com – A comprehensive resource for financial education

2) Khan Academy’s personal finance courses – Free in-depth lessons on investing and personal finance

3) Yahoofinance.com: For investment research, analysis, and personal finance article

Podcasts:

1) The Ramsey Show – Focuses on getting out of debt and financial discipline

2) Afford Anything – Great for understanding the psychology of money

3) Stacking Benjamins – Makes finance fun and accessible

Conclusion

Should You Pay Off Debt or Invest First

Should You Pay Off Debt or Invest First?

Should You Pay Off Debt or Invest First? 💭

It’s one of the most common questions in personal finance — should you pay off debt first or start investing? The answer depends on your financial situation, but if you’re carrying high-interest debt (especially consumer debt like credit cards 💳), the smartest move is almost always to tackle that first.

The Heavy Cost of Debt Over Time 💸

Let’s look at how expensive debt can really be. Imagine you have $10,000 in credit card debt with an interest rate of 20%. Even if you commit to paying a fixed $200 per month (which is more than most minimum payments), the numbers are shocking.

Take a look at what that debt will actually cost you:

💳 The True Cost of Credit Card Debt

Making a Fixed $200 Monthly Payment

That’s $11,680 that could have been invested, saved, or used to build your financial future — instead, it goes to the bank. 💸

💡 Want to See Your Own Numbers?

Use our free Credit Card Interest Cost Calculator to find out exactly how much your debt is costing you and how long it will take to pay off with different payment amounts.

Try the Calculator →That’s $11,680 in interest alone — more than the original amount you borrowed! Over 9 years, you’ll pay back $21,680 total for that $10,000 purchase. And this assumes you never add another dollar to that balance. 😳

That’s money that could have been invested or saved for your future — but instead, it’s being handed over to the bank month after month. When you think about it that way, paying off debt becomes one of the best “investments” you can make.

The Freedom of Being Debt-Free ✨

There’s something powerful about being debt-free. It’s not just about the numbers — it’s about the peace of mind that comes with knowing you don’t owe anyone anything. That feeling of freedom changes the way you think, spend, and invest.

People who’ve paid off their debt often experience a major mindset shift. Instead of feeling trapped or anxious about payments, they’re free to focus on building wealth, not just surviving from paycheck to paycheck. They start viewing money as a tool for growth, rather than a burden.

That shift — from debt-driven to purpose-driven — is one of the most important transformations on the journey to financial independence. 💪

When It Might Make Sense to Invest First 📈

There are a couple of exceptions where investing before fully paying off debt makes sense:

- Employer Retirement Match: If your company offers a 401(k) match, it’s essentially free money. I’d prioritize contributing at least enough to get that match — but if your debt has an extremely high interest rate (like 25% on a credit card), I’d still consider pausing investing temporarily to attack that balance first.

- Mortgage Debt: Mortgage rates are generally much lower and may offer tax benefits. Because of that, paying off a home loan early isn’t always the best use of extra cash — especially if your money could earn more invested elsewhere.

Outside of those exceptions, focusing on paying down debt will almost always provide the best long-term benefit. Once you’re free from high-interest balances, you can redirect those monthly payments straight into your investment accounts — and that’s when your wealth really starts to grow. 🚀

Final Thoughts 💬

Paying off debt isn’t just about getting ahead financially — it’s about taking back control. The peace of mind that comes with being debt-free is worth more than any short-term investment gain. Once your high-interest debts are gone, you’ll be in a much stronger position to invest consistently and build lasting wealth.

Remember: the goal isn’t just to have more money — it’s to have freedom, security, and confidence in your financial future. And that starts with getting rid of the debt that’s holding you back. 💯

How Anyone Can Be a Millionaire

How Anyone Can Be a Millionaire

How Anyone Can Be a Millionaire: Tips for Building Wealth 💰

When most people picture a millionaire, they imagine someone living in a mansion, driving a luxury car, or taking extravagant vacations.

But here’s the truth — most millionaires are far more ordinary than you think. They’re the neighbors down the street who live modestly, drive everyday cars, and quietly build wealth over time.

In The Millionaire Next Door, author Thomas J. Stanley dives deep into this concept and reveals eye-opening facts about the real millionaires among us. His research shattered the stereotype, proving that genuine wealth is built through discipline, not flash.

What Is a Millionaire, Really?

A millionaire isn’t defined by income or spending habits. It’s someone whose net worth equals or exceeds one million dollars.

Here’s how it’s calculated:

Assets – Liabilities = Net Worth

- Assets include cash, investments, retirement accounts, cars, and your home.

- Liabilities are debts such as mortgages, car loans, credit card balances, and student loans.

Being a millionaire is a matter of building assets and minimizing debt.

Mindset and Discipline Matter Most

Your income matters, but the real keys to wealth are mindset and discipline. If you consistently spend less than you earn and invest the difference, time and compound interest will do the heavy lifting. Stick to your plan, and you’ll eventually cross the millionaire mark.

Start Early and Save Consistently ⏰

The earlier you start, the more powerful your money becomes. That’s the magic of compound interest.

If you’re struggling to make ends meet, start small — even a few dollars a week matters. Building wealth is like working out: one session won’t show results, but consistent effort over time transforms your financial “fitness.”

Direct a portion of your paycheck into a 401(k) or IRA automatically — before you even see it. Pretend that money doesn’t exist so you’re not tempted to spend it.

Think of it like buying a golden goose 🥚, except… in the beginning it lays copper egg, then silver… and before you know it she’s finally laying the golden eggs!

Want to see how powerful compound interest can be?

👉 Try our Investment Calculator

Live Below Your Means 💸

Living below your means is a key component of building wealth, and simply means spending less than you earn and avoiding unnecessary expenses. Focus on essentials and prioritize savings and investments. Using a budgeting app can help track spending and identify areas to cut back.

Invest Wisely

Investing is one of the most effective ways to grow wealth — but it must be done wisely. Instead of chasing “hot” stocks, focus on a diversified portfolio of low-cost index funds for stability and long-term growth.

Avoid high-risk investments, and if you’re unsure, speak with a trusted financial advisor.

Eliminate Debt 🔓

Debt is the anchor holding you back from financial freedom. Prioritize paying off credit cards, student loans, and other high-interest obligations quickly. Make short-term sacrifices and stay laser-focused on eliminating what’s weighing you down. Once you’re debt-free, redirect that same intensity toward investing and building wealth—your path to becoming a millionaire starts here.

Maximize Your Earning Potential 💼

While saving and investing are vital, earning more accelerates your journey to millionaire status. Ways to boost income include:

- → Advance your education or learn new skills to qualify for higher-paying roles.

- → Start a side hustle or explore real estate for additional income streams.

- → Negotiate for higher pay or better benefits in your current job.

Keep Your Eye on the Prize 🎯

Becoming a millionaire won’t happen overnight. It takes patience, discipline, and commitment. Stay focused on your “why” — whether it’s financial independence, freedom from debt, or creating generational wealth — and let that goal guide your decisions.

Small, consistent actions compound into extraordinary results over time.

Final Thoughts: The Millionaire Mindset

Becoming a millionaire isn’t reserved for the lucky few — it’s attainable for anyone willing to work, learn, and stay disciplined.

Adopt the right mindset, build strong financial habits, and remain consistent. By starting early, living below your means, investing wisely, and avoiding debt, you’ll be on your way to building lasting wealth.

Financial freedom isn’t a dream. It’s a decision — and it starts today 💪.

What is Financial Independence, and How Do You Achieve It?

What is Financial Independence, and How Do You Achieve It?

In today’s fast-paced, consumer-driven world, more people are waking up to a life-changing goal: financial independence 💸. But what does that actually mean, and more importantly—how do you achieve it?

What is Financial Independence?

Financial independence (FI) means having enough money invested or saved that you no longer rely on active income to fund your lifestyle. In simple terms, your money works for you—whether you choose to work or not.

A common benchmark for FI is when your investments can safely cover your living expenses indefinitely. This brings us to one of the most well-known concepts in the FI community: the 4% rule.

Understanding the 4% Rule

The 4% rule is a popular guideline in the financial independence community that suggests you can withdraw 4% of your investment portfolio annually and expect it to last at least 30 years. This concept was first introduced by William Bengen, a financial advisor who published the idea in a groundbreaking article entitled Determining Withdrawal Rates Using Historical Data in 1994 . His findings were later confirmed and expanded by the Trinity Study, a research paper by three professors at Trinity University in 1998.

- If your annual expenses are $80,000, you would need $2 million invested ($80,000 ÷ 0.04).

- The rule assumes a diversified portfolio of stocks and bonds and is based on historical market performance.

🔎 Want to dive deeper?

Check out a detailed analysis by Michael Kitces in his white paper regarding safe withdrawal rates.

How to Achieve Financial Independence 🏡

Let’s break down the key habits and strategies that can accelerate your journey to financial freedom:

1. Start Early—Time Is Your Greatest Asset ⏳

Compound interest works best with time. Starting in your 20’s can mean the difference between needing $500/month versus $1,500/month in investments later on. The earlier you start, the less effort is needed to hit your goal.

📚 Want to learn more? Read this excellent primer on compound interest from Investopedia.

2. Be Consistent—Small Wins Add Up ✅

Achieving FI isn’t about winning the lottery or scoring a huge raise. It’s about consistent saving and investing, even if the amounts are modest. Automate contributions to your retirement accounts, brokerage, or high-yield savings. Over time, this discipline compounds.

👍 Check out Fidelity’s guide to dollar-cost averaging as a practical strategy.

3. Practice Financial Discipline 🔒

Discipline means saying “no” to impulse purchases, lifestyle inflation, and societal pressure to “keep up.” It also means sticking to your investment strategy even when markets are volatile. Your future self will thank you.

4. Avoid or Minimize Debt ❌

Debt is the ultimate speed bump on your FI journey. High-interest debt like credit cards can destroy your net worth faster than you can build it. Prioritize paying down debt aggressively—especially consumer debt—before ramping up investments.

🔧 Read more on the truth about debt by Dave Ramsey

5. Don’t Worry About What Others Think 🎯

The FI path often looks different from the norm. You might drive an older car, skip fancy vacations, or live below your means while others spend freely. Ignore the noise. Financial independence is freedom, and that’s far more valuable than approval.

6. Choose a Partner Who Shares Your Vision 👩🏻❤️💋👨🏻

Having a life partner who’s financially aligned with your goals is a game-changer. Shared values around saving, spending, and investing create momentum and reduce conflict. Together, you can achieve FI faster and with less stress.

The Real Benefit of Financial Independence 🌍

It’s not just about never working again. It’s about freedom:

- Freedom to walk away from toxic work environments

- Freedom to pursue passion projects

- Freedom to spend more time with family

- Freedom to live life on your terms

That’s the ultimate return on investment.

Final Thoughts 🚀

Achieving financial independence requires clarity, consistency, and courage. It’s not always easy, but it’s always worth it. Start today, stay disciplined, ignore the distractions, and partner with those who support your goals. Your future freedom depends on the choices you make now.

For more on the FI movement, check out ChooseFI’s beginner guide to reaching financial independence.

Building a Budget That Works

Building a Budget That Works For You

Building a budget that works for You: Your Path to financial success

Here’s the truth about budgeting: it only works when it works for you. The best budget isn’t about restricting everything you enjoy—it’s about balancing your goals with the life you want to live right now

💰Step 1: Determine Your Net Income

Calculate your monthly income after taxes. This would include income from side hustles, tip income, and any other income if you have it.

If you are self employed, don’t forget to account for taxes you’ll owe on this type of income. TaxAct has a self employment tax calculator which will help estimate your tax obligations.

📊 Step 2: Know Your Spending Habits

Before you begin building a budget that works for you, you will need to know where your money is going. This means tracking your expenses, no matter how small.

Make sure to include large expenses that may not occur every month. Things like property taxes, insurance payments, vacations, Christmas, etc. Estimate the annual cost of and set aside a monthly amount for these type of expenses so you’re ready when the payments are due.

Use one of these methods:

📱 Budgeting apps like Monarch Money, EveryDollar, Quicken are relatively easy to use and can connect with your accounts to simplify the process

📑 Spreadsheets can be effective if you’re organized and diligent with your receipts

📓 Notebook for those old school folks who prefer pen and paper

Pick whatever tracking method feels easiest—an app, a spreadsheet, even pen and paper. The important part is taking action, just start. You’ll probably be shocked by what you’re actually spending,

🤝 Step 3: Get on the Same Page with Your Partner

Money fights are one of the top relationship killers, but they don’t have to be. If you’re in a relationship, you need to talk money. It sounds obvious, but many couples avoid it until it becomes a problem. Getting aligned on goals and spending now saves so much drama later.

Action item: Schedule a “money date” with your partner to discuss your financial goals, concerns, and habits. Make it a regular occurrence, perhaps monthly. Be sure to discuss both necessary expenses and discretionary spending.

🎯 Step 4: Tailor Your Budget to Your Lifestyle and Goals

There’s no one-size-fits-all approach to budgeting. Your budget should reflect your lifestyle and financial goals, which is unique to you. Are you saving for a house? Planning for an early retirement? Paying off debt? Your budget should support these objectives while also allowing for some flexibility.

Action item: Write down your short-term and long-term financial goals. Then, allocate your income accordingly in your budget, making sure to include categories for both necessities and discretionary spending.

💡 Pro Budget Tip

Focus on paying off credit card, car loans, personal loans, and any other consumer debt as quickly as possible. You’ll be amazed how quickly your net worth will increase when you eliminate your debt service payements

🎉 Step 5: Set Yourself Up for Success.

A good budget isn’t just about restriction—it’s about empowerment. Include some fun funds in your budget to avoid feeling overly constrained. Also, automate your savings and bill payments where possible to make sticking to your budget easier, and avoid late fees.

Action item: Set up automatic transfers to your savings account on payday. Start small if needed—even $20 a week adds up over time.

💡 Smart Budget Strategies

Automate Your Finances

* Set up automatic bill pay

* Create automatic transfers to savings

* Use direct deposit to separate accounts

🔍 Step 6: Regularly Review and Adjust

As your life circumstances change, so should your budget. Regular review ensures that your budget continues to align with your goals and needs.

Action item: Schedule quarterly budget reviews. Assess whether your current allocations are working. Are you meeting your saving goals? Is your budget sustainable? Adjust as necessary.

🏋️♂️ Step 7: Bounce Back When You Fall Off Track

Nobody’s perfect, and there will likely be times when you overspend or forget to track an expense. The key is not to let these slip-ups derail your entire budget. Instead, view them as learning opportunities.

Action item: When you go over budget, don’t beat yourself up. Instead, analyze what happened. Was it a one-time expense or a sign that your budget needs adjusting?

If you’re having trouble staying on track, try switching to cash for items like groceries, clothing, dining out, and miscellaneous shopping.

✉️ Step 8: Try the Envelope System

This old-school method is surprisingly effective: start with some envelopes and label each one with a spending category, groceries, gas, eating out, whatever fits your life. When payday hits, fill each envelope with the cash you’ve budgeted for that category.

The rule? When an envelope’s empty, you’re done spending in that category until next payday. And before you think about “borrowing” from another envelope—don’t. That’s how the system falls apart.

Here’s why it works: There’s something about physically handing over cash that makes spending feel more real than swiping a card ever will.

Final Thoughts

Keep in mind: nobody builds a perfect budget on day one. It’s a skill you build over time, so give yourself grace when things don’t go as expected. Budgeting doesn’t have to be perfect, but you should be making progress. Stick with it, adjust as you go, and actually acknowledge when you’re doing well. Those wins matter and build momentum.

The beauty of a budget that works for you is it doesn’t feel like sacrifice. You’re not choosing between enjoying today and securing tomorrow, creating a budget that works for you will help you do both. After all, the point of getting your finances together isn’t just to watch numbers grow in a savings account. It’s about building a life where money supports your dreams instead of holding you back.